Amortization On The Balance Sheet

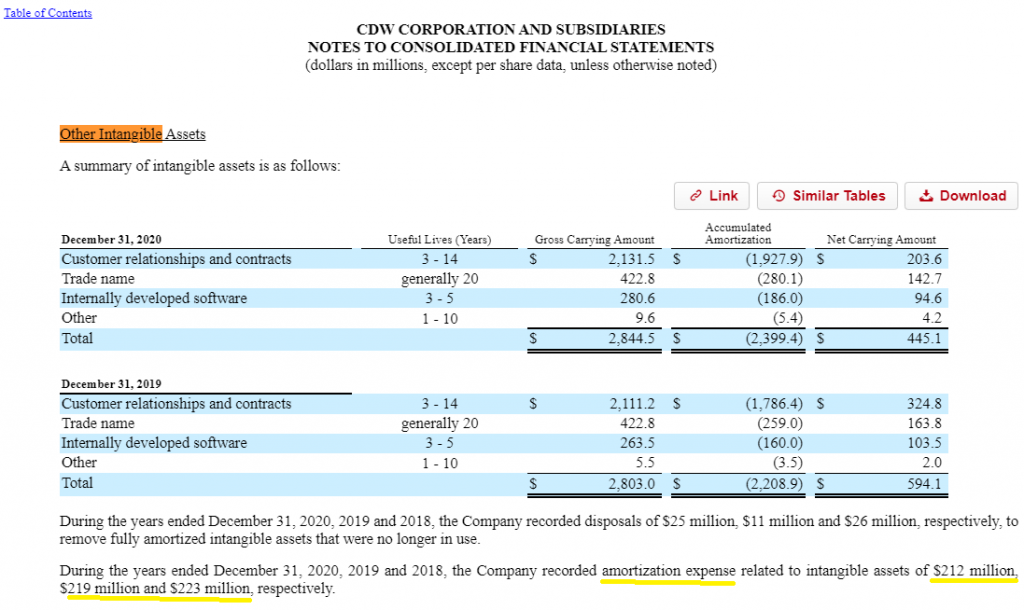

Amortization On The Balance Sheet - Web what are the different amortization methods? Web explaining amortization in the balance sheet amortization. This linear method allocates the total cost amount as the same each year until the asset’s. Web january 3, 2021 in business, amortization is the practice of writing down the value of an intangible asset, such as a copyright or patent, over its useful life. Amortization refers to capitalizing the value of an intangible asset over time. The difference between these two accounts shows the net value of the intangible. Web the accumulated amortization account appears as a deduction from the intangible asset account on the balance sheet. Amortization schedules are used by lenders, such as financial institutions, to. Amortization expenses can affect a company’s income. Web amortization typically refers to the process of writing down the value of either a loan or an intangible asset.

Web what are the different amortization methods? Amortization schedules are used by lenders, such as financial institutions, to. Amortization expenses can affect a company’s income. Web january 3, 2021 in business, amortization is the practice of writing down the value of an intangible asset, such as a copyright or patent, over its useful life. Web the accumulated amortization account appears as a deduction from the intangible asset account on the balance sheet. Amortization refers to capitalizing the value of an intangible asset over time. Web amortization typically refers to the process of writing down the value of either a loan or an intangible asset. This linear method allocates the total cost amount as the same each year until the asset’s. The difference between these two accounts shows the net value of the intangible. Web explaining amortization in the balance sheet amortization.

Web the accumulated amortization account appears as a deduction from the intangible asset account on the balance sheet. Web january 3, 2021 in business, amortization is the practice of writing down the value of an intangible asset, such as a copyright or patent, over its useful life. Web amortization typically refers to the process of writing down the value of either a loan or an intangible asset. This linear method allocates the total cost amount as the same each year until the asset’s. Amortization refers to capitalizing the value of an intangible asset over time. Amortization schedules are used by lenders, such as financial institutions, to. Web what are the different amortization methods? Amortization expenses can affect a company’s income. The difference between these two accounts shows the net value of the intangible. Web explaining amortization in the balance sheet amortization.

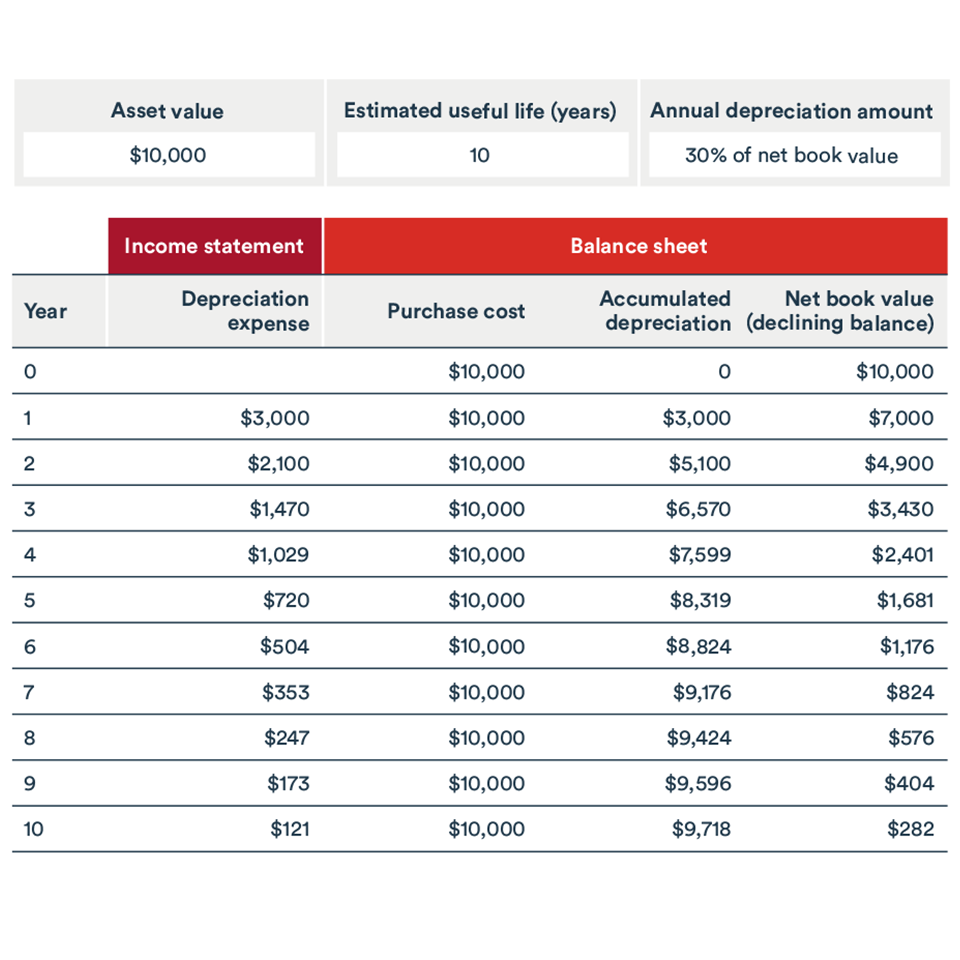

Amortization vs. Depreciation What's the Difference? (2022)

This linear method allocates the total cost amount as the same each year until the asset’s. Web what are the different amortization methods? Amortization expenses can affect a company’s income. Web explaining amortization in the balance sheet amortization. Web the accumulated amortization account appears as a deduction from the intangible asset account on the balance sheet.

How Amortization of Intangible Assets Works; When it Unleashes Higher ROIC

Web explaining amortization in the balance sheet amortization. This linear method allocates the total cost amount as the same each year until the asset’s. The difference between these two accounts shows the net value of the intangible. Amortization schedules are used by lenders, such as financial institutions, to. Amortization refers to capitalizing the value of an intangible asset over time.

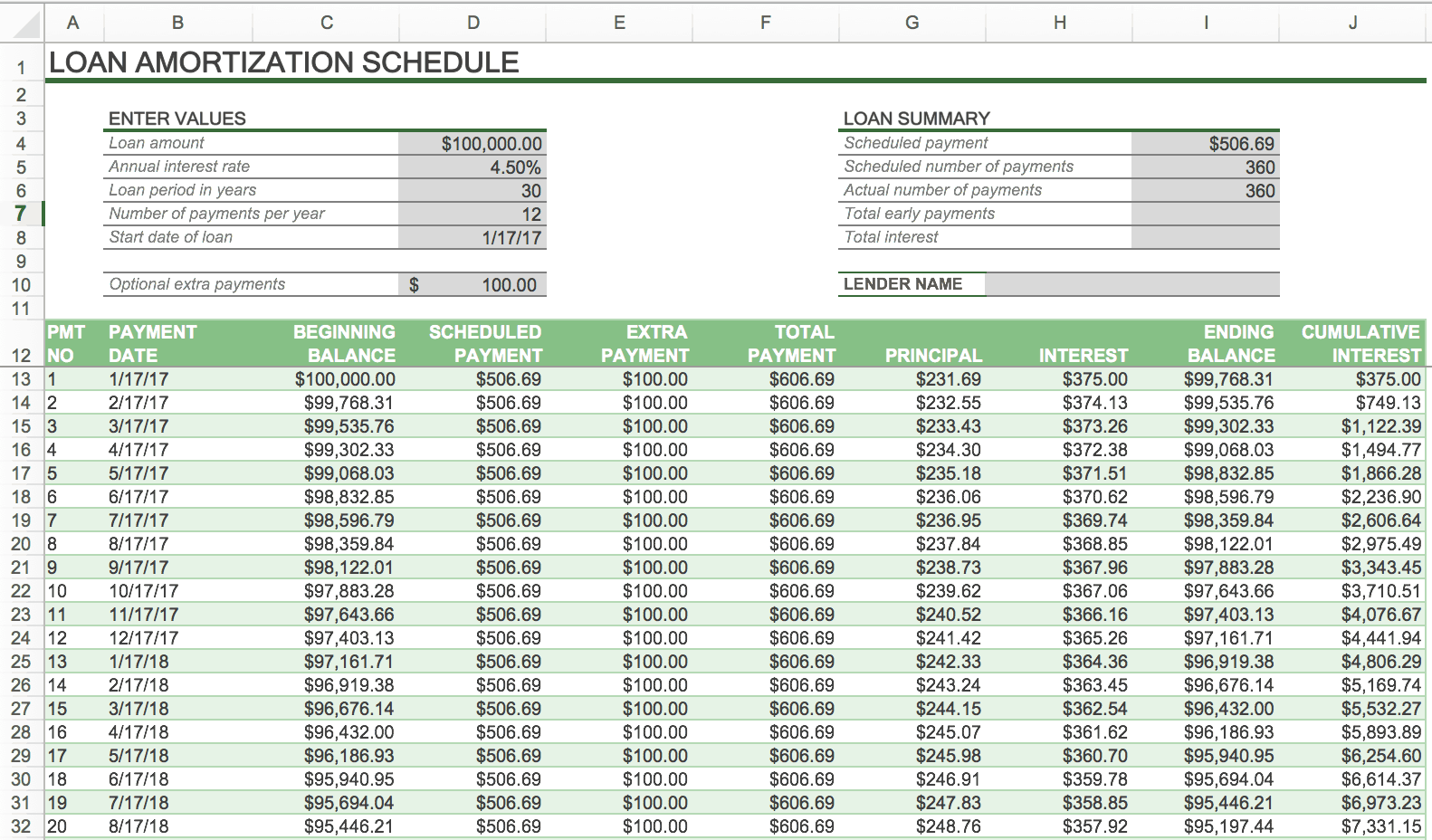

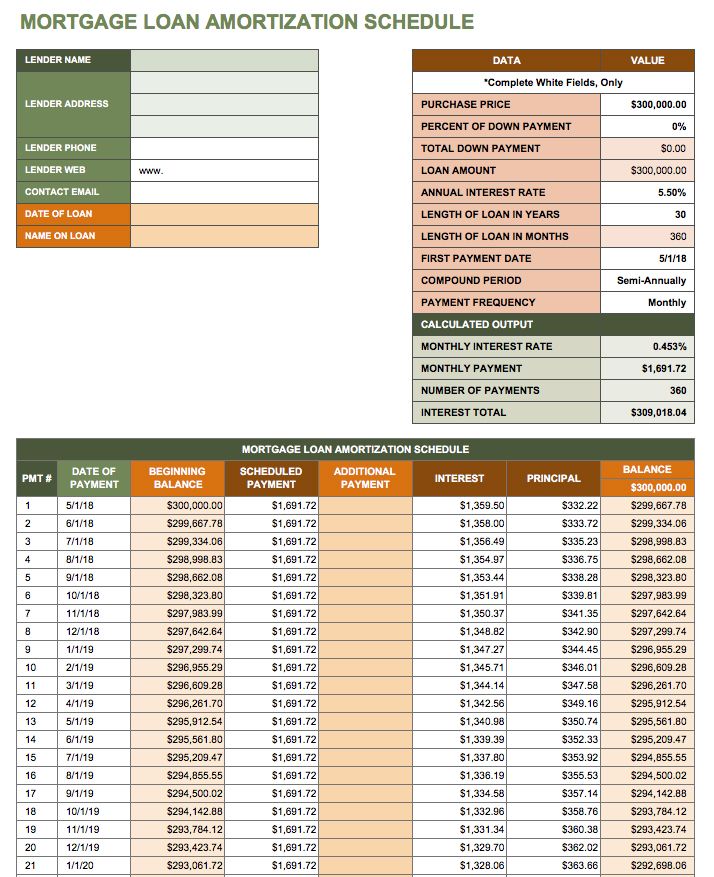

Microsoft Excel Amortization Templates mailaxen

The difference between these two accounts shows the net value of the intangible. Web the accumulated amortization account appears as a deduction from the intangible asset account on the balance sheet. Amortization schedules are used by lenders, such as financial institutions, to. Web explaining amortization in the balance sheet amortization. Web what are the different amortization methods?

Amortisation Schedule Excel Template

This linear method allocates the total cost amount as the same each year until the asset’s. Web the accumulated amortization account appears as a deduction from the intangible asset account on the balance sheet. Amortization expenses can affect a company’s income. Web january 3, 2021 in business, amortization is the practice of writing down the value of an intangible asset,.

Goodwill, Patents, and Other Intangible Assets Financial Accounting

Web amortization typically refers to the process of writing down the value of either a loan or an intangible asset. Web explaining amortization in the balance sheet amortization. The difference between these two accounts shows the net value of the intangible. Amortization expenses can affect a company’s income. Amortization refers to capitalizing the value of an intangible asset over time.

How to Calculate Amortization on Patents 10 Steps (with Pictures)

Amortization refers to capitalizing the value of an intangible asset over time. The difference between these two accounts shows the net value of the intangible. Web the accumulated amortization account appears as a deduction from the intangible asset account on the balance sheet. This linear method allocates the total cost amount as the same each year until the asset’s. Web.

What is amortization BDC.ca

The difference between these two accounts shows the net value of the intangible. This linear method allocates the total cost amount as the same each year until the asset’s. Web amortization typically refers to the process of writing down the value of either a loan or an intangible asset. Web what are the different amortization methods? Amortization schedules are used.

Prepaid Amortization Schedule Excel Template

Web what are the different amortization methods? Web the accumulated amortization account appears as a deduction from the intangible asset account on the balance sheet. Amortization expenses can affect a company’s income. This linear method allocates the total cost amount as the same each year until the asset’s. Amortization schedules are used by lenders, such as financial institutions, to.

Amortization Schedules and Balance Sheet YouTube

Web what are the different amortization methods? This linear method allocates the total cost amount as the same each year until the asset’s. Web amortization typically refers to the process of writing down the value of either a loan or an intangible asset. Web january 3, 2021 in business, amortization is the practice of writing down the value of an.

Basic Amortization Schedule Excel Excel Templates

The difference between these two accounts shows the net value of the intangible. This linear method allocates the total cost amount as the same each year until the asset’s. Web what are the different amortization methods? Amortization schedules are used by lenders, such as financial institutions, to. Web the accumulated amortization account appears as a deduction from the intangible asset.

Web Amortization Typically Refers To The Process Of Writing Down The Value Of Either A Loan Or An Intangible Asset.

Web january 3, 2021 in business, amortization is the practice of writing down the value of an intangible asset, such as a copyright or patent, over its useful life. Amortization refers to capitalizing the value of an intangible asset over time. Web the accumulated amortization account appears as a deduction from the intangible asset account on the balance sheet. Web explaining amortization in the balance sheet amortization.

The Difference Between These Two Accounts Shows The Net Value Of The Intangible.

This linear method allocates the total cost amount as the same each year until the asset’s. Amortization expenses can affect a company’s income. Web what are the different amortization methods? Amortization schedules are used by lenders, such as financial institutions, to.

:max_bytes(150000):strip_icc()/Amazon3-88916bd66a244178b1f977a1d758dda0.JPG)