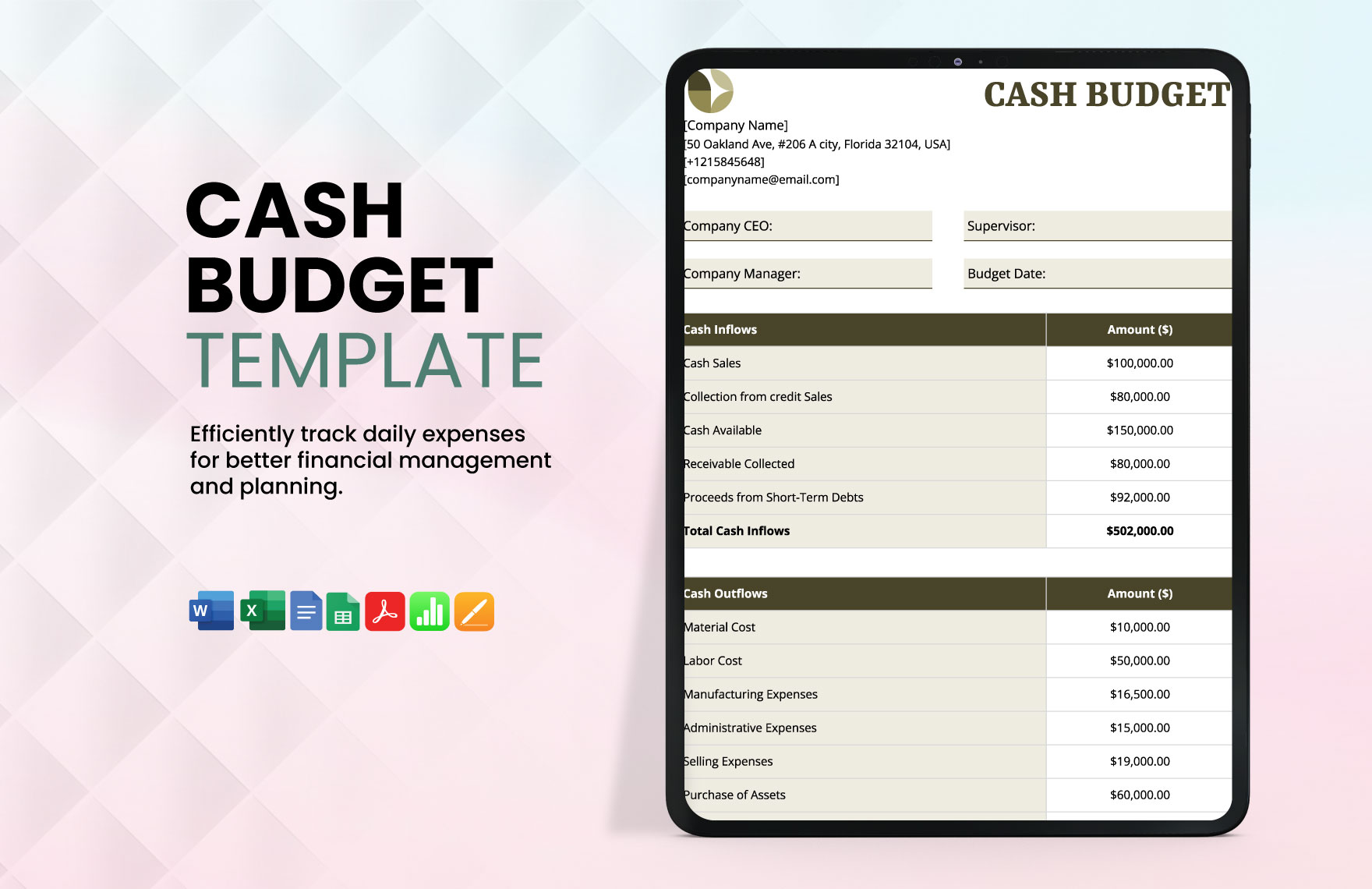

Cash Budget Template

Cash Budget Template - Initial cash flow into the spreadsheet. Most assets and liabilities on the balance sheet are listed at their book value (rather than their fair market value). To keep things simple, we’ll assume any dividends paid by the etf have been reinvested in the fund, rather than paid out as cash. Net assets are not equal to the cash a company would have remaining if it sold everything. Based on the results of the calculator, we see that our investment of. For example, if a company's cash budget forecasts. Keep in mind that this initial investment has to be a negative number. A cash budget is a planning tool used by companies and individuals to evaluate projected cash flows during a specified period of time (e.g. The company plans to invest $100,000 on new machinery, $25,000 in hiring a new salesperson, and $25,000 on marketing. We can add these cash outflows (or costs of investment) to generate a total projected cost:.

The company plans to invest $100,000 on new machinery, $25,000 in hiring a new salesperson, and $25,000 on marketing. Keep in mind that this initial investment has to be a negative number. A cash budget is a planning tool used by companies and individuals to evaluate projected cash flows during a specified period of time (e.g. For example, if a company's cash budget forecasts. Initial cash flow into the spreadsheet. Net assets are not equal to the cash a company would have remaining if it sold everything. To keep things simple, we’ll assume any dividends paid by the etf have been reinvested in the fund, rather than paid out as cash. Based on the results of the calculator, we see that our investment of. We can add these cash outflows (or costs of investment) to generate a total projected cost:. Most assets and liabilities on the balance sheet are listed at their book value (rather than their fair market value).

Initial cash flow into the spreadsheet. The company plans to invest $100,000 on new machinery, $25,000 in hiring a new salesperson, and $25,000 on marketing. Keep in mind that this initial investment has to be a negative number. To keep things simple, we’ll assume any dividends paid by the etf have been reinvested in the fund, rather than paid out as cash. Based on the results of the calculator, we see that our investment of. We can add these cash outflows (or costs of investment) to generate a total projected cost:. A cash budget is a planning tool used by companies and individuals to evaluate projected cash flows during a specified period of time (e.g. For example, if a company's cash budget forecasts. Most assets and liabilities on the balance sheet are listed at their book value (rather than their fair market value). Net assets are not equal to the cash a company would have remaining if it sold everything.

Cash Template in Word FREE Download

For example, if a company's cash budget forecasts. To keep things simple, we’ll assume any dividends paid by the etf have been reinvested in the fund, rather than paid out as cash. We can add these cash outflows (or costs of investment) to generate a total projected cost:. Most assets and liabilities on the balance sheet are listed at their.

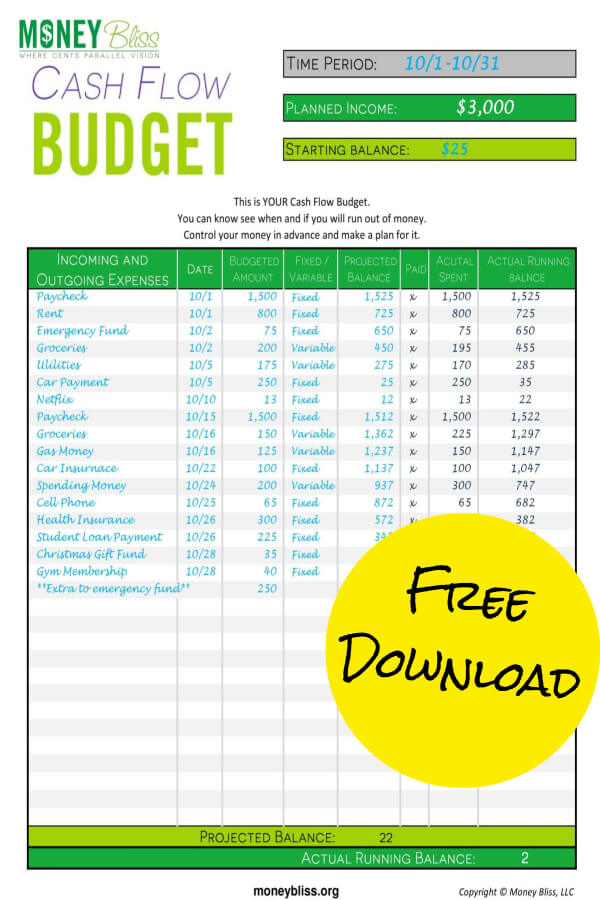

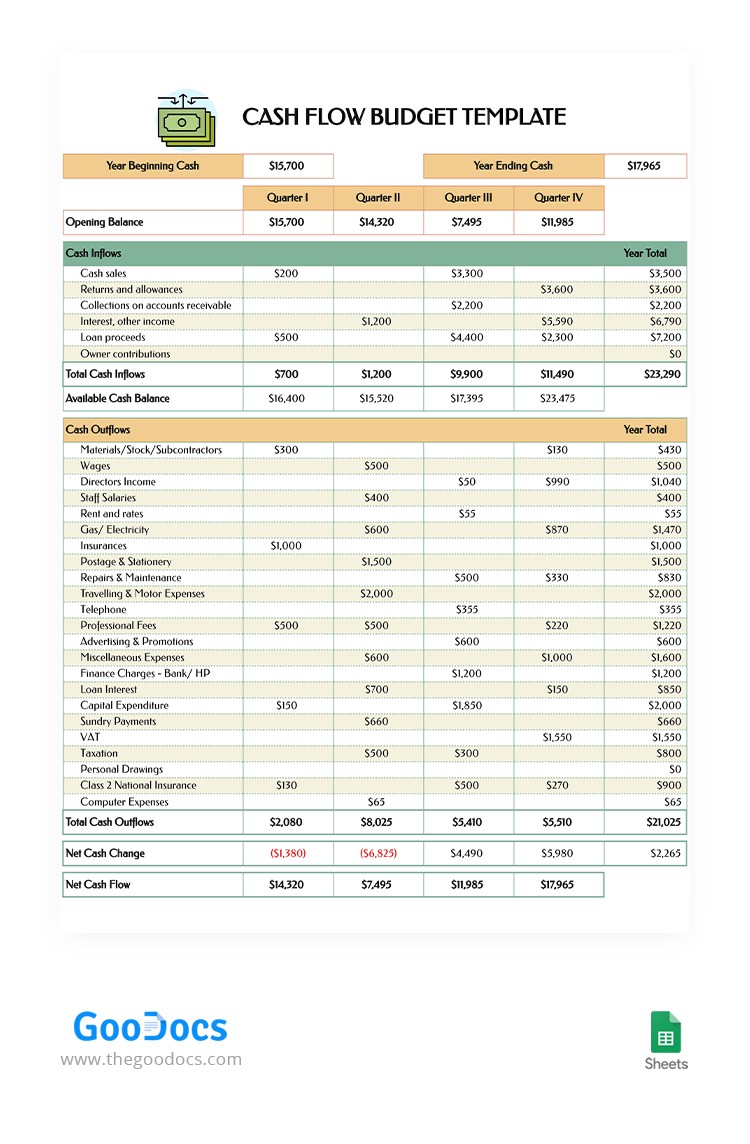

Why You Need a Cash Flow Budget + How To Make One Money Bliss

Most assets and liabilities on the balance sheet are listed at their book value (rather than their fair market value). For example, if a company's cash budget forecasts. The company plans to invest $100,000 on new machinery, $25,000 in hiring a new salesperson, and $25,000 on marketing. Net assets are not equal to the cash a company would have remaining.

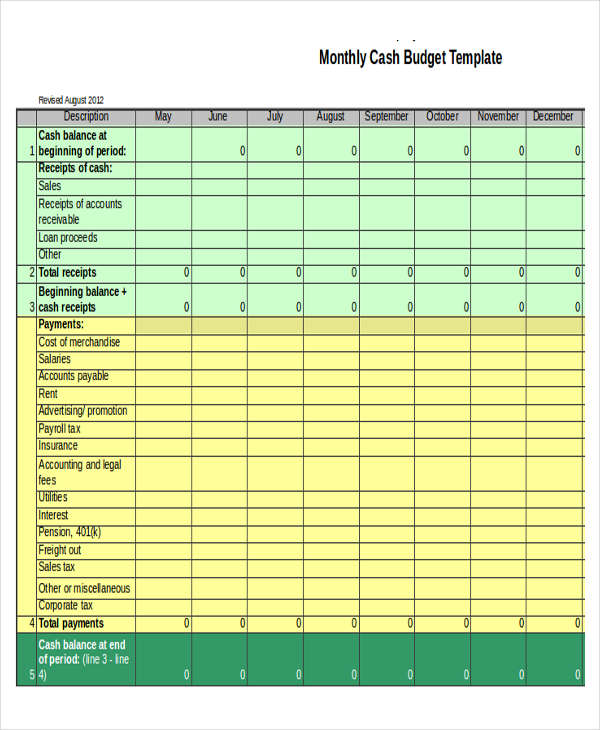

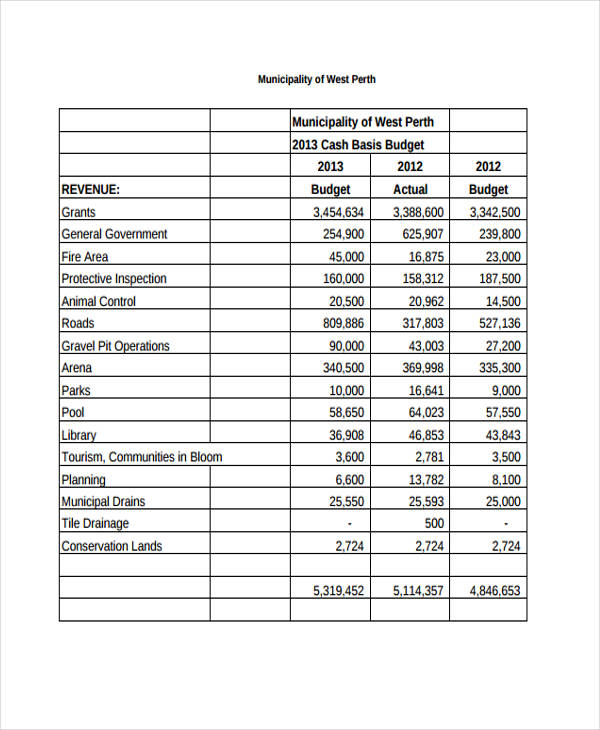

11+ Cash Budget Templates Free Sample,Example Format Download Free

The company plans to invest $100,000 on new machinery, $25,000 in hiring a new salesperson, and $25,000 on marketing. We can add these cash outflows (or costs of investment) to generate a total projected cost:. A cash budget is a planning tool used by companies and individuals to evaluate projected cash flows during a specified period of time (e.g. Based.

7+ Cash Budget Templates Word, PDF Free & Premium Templates

Initial cash flow into the spreadsheet. Most assets and liabilities on the balance sheet are listed at their book value (rather than their fair market value). A cash budget is a planning tool used by companies and individuals to evaluate projected cash flows during a specified period of time (e.g. The company plans to invest $100,000 on new machinery, $25,000.

11+ Cash Budget Templates Free Sample,Example Format Download Free

Initial cash flow into the spreadsheet. We can add these cash outflows (or costs of investment) to generate a total projected cost:. The company plans to invest $100,000 on new machinery, $25,000 in hiring a new salesperson, and $25,000 on marketing. To keep things simple, we’ll assume any dividends paid by the etf have been reinvested in the fund, rather.

Cash Budget Example Template Business

Initial cash flow into the spreadsheet. Most assets and liabilities on the balance sheet are listed at their book value (rather than their fair market value). Keep in mind that this initial investment has to be a negative number. Net assets are not equal to the cash a company would have remaining if it sold everything. For example, if a.

Cash Budget Template Excel

Most assets and liabilities on the balance sheet are listed at their book value (rather than their fair market value). Initial cash flow into the spreadsheet. The company plans to invest $100,000 on new machinery, $25,000 in hiring a new salesperson, and $25,000 on marketing. Based on the results of the calculator, we see that our investment of. Keep in.

7+ Cash Budget Templates Word, PDF Free & Premium Templates

Most assets and liabilities on the balance sheet are listed at their book value (rather than their fair market value). We can add these cash outflows (or costs of investment) to generate a total projected cost:. Keep in mind that this initial investment has to be a negative number. The company plans to invest $100,000 on new machinery, $25,000 in.

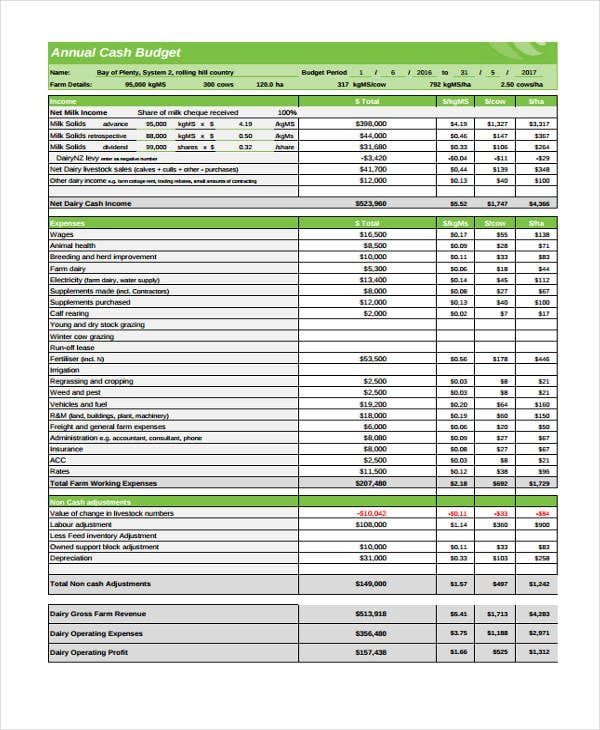

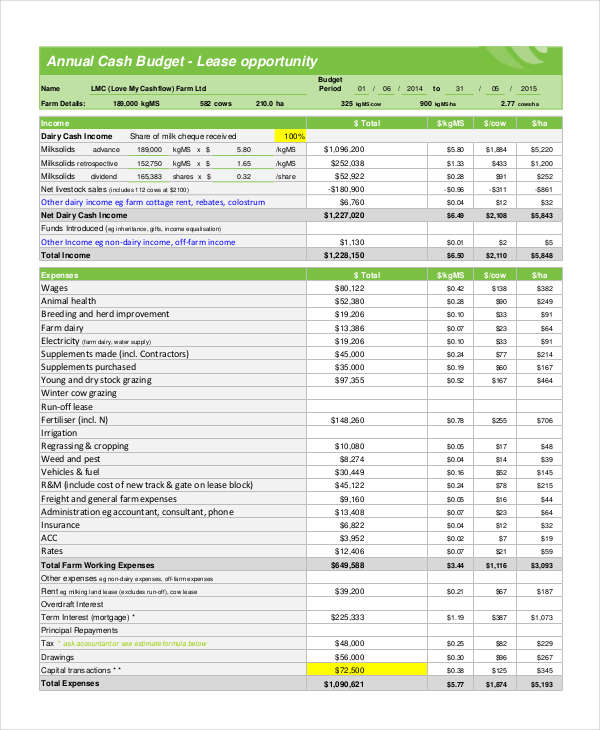

Annual Cash Budget Schedule Excel Template And Google Sheets File For

Net assets are not equal to the cash a company would have remaining if it sold everything. A cash budget is a planning tool used by companies and individuals to evaluate projected cash flows during a specified period of time (e.g. Based on the results of the calculator, we see that our investment of. Most assets and liabilities on the.

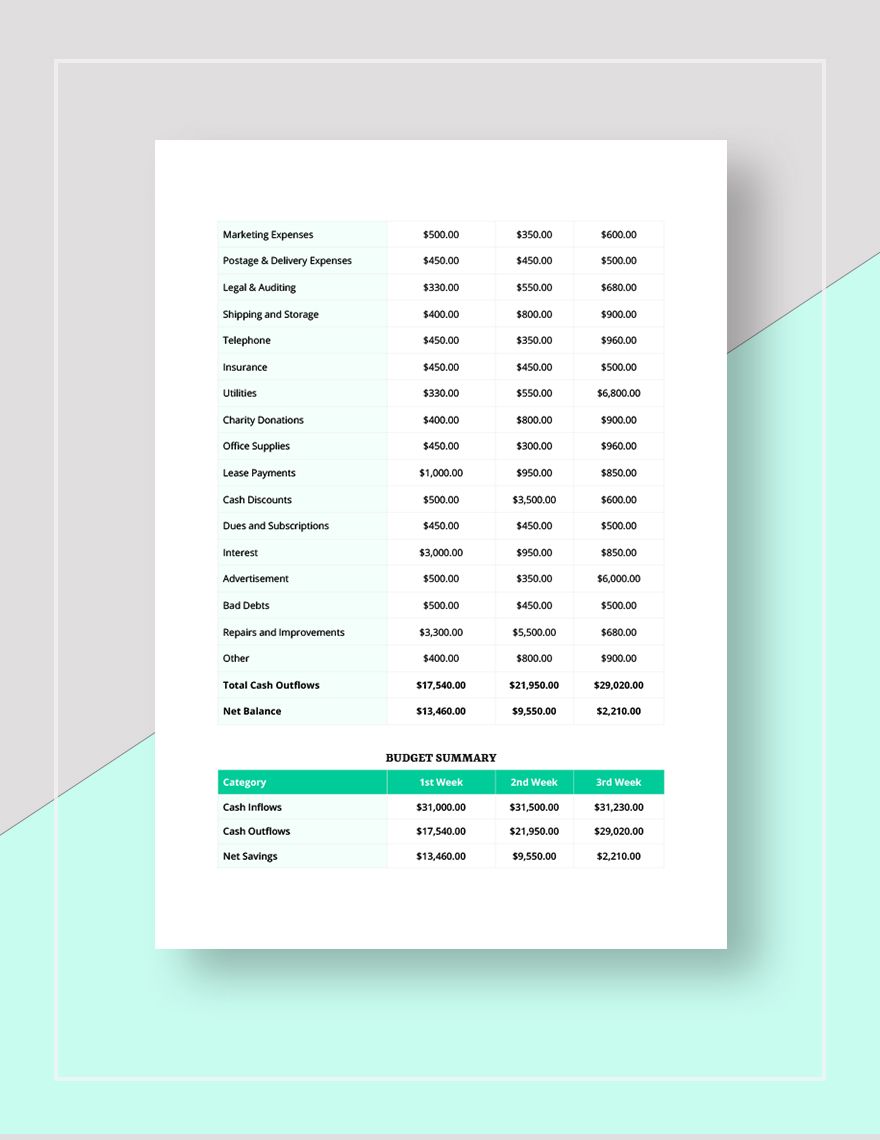

Weekly Cash Budget Template in Google Docs, Google Sheets, Excel, Word

A cash budget is a planning tool used by companies and individuals to evaluate projected cash flows during a specified period of time (e.g. Net assets are not equal to the cash a company would have remaining if it sold everything. Initial cash flow into the spreadsheet. We can add these cash outflows (or costs of investment) to generate a.

Net Assets Are Not Equal To The Cash A Company Would Have Remaining If It Sold Everything.

Keep in mind that this initial investment has to be a negative number. The company plans to invest $100,000 on new machinery, $25,000 in hiring a new salesperson, and $25,000 on marketing. Initial cash flow into the spreadsheet. To keep things simple, we’ll assume any dividends paid by the etf have been reinvested in the fund, rather than paid out as cash.

Based On The Results Of The Calculator, We See That Our Investment Of.

For example, if a company's cash budget forecasts. A cash budget is a planning tool used by companies and individuals to evaluate projected cash flows during a specified period of time (e.g. Most assets and liabilities on the balance sheet are listed at their book value (rather than their fair market value). We can add these cash outflows (or costs of investment) to generate a total projected cost:.