Cd Ladder Spreadsheet Template

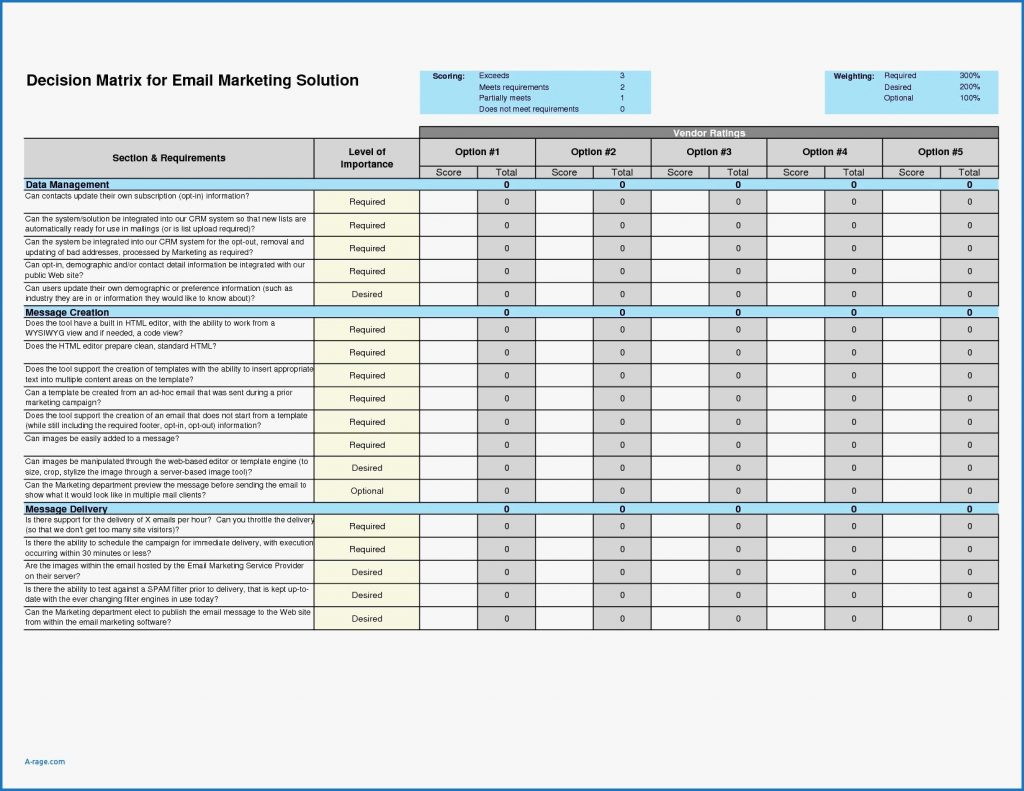

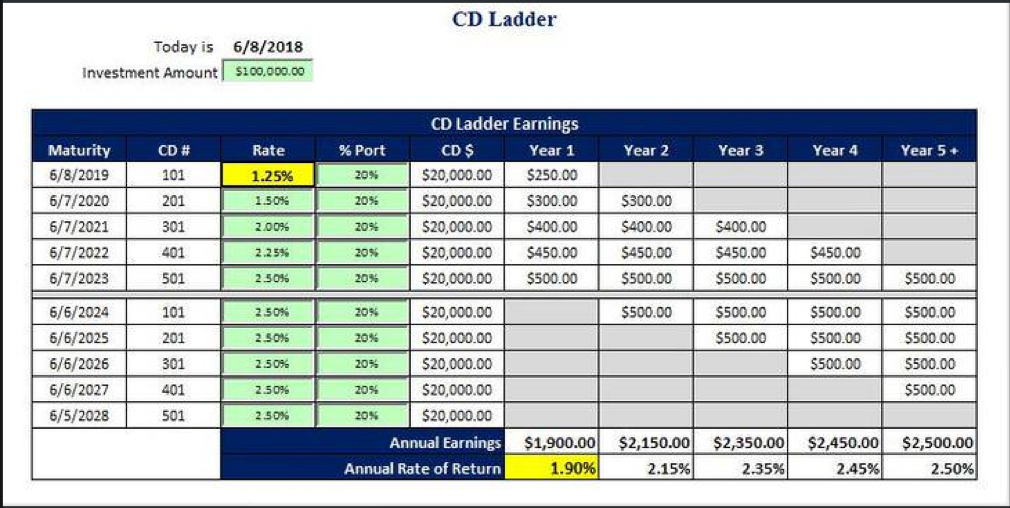

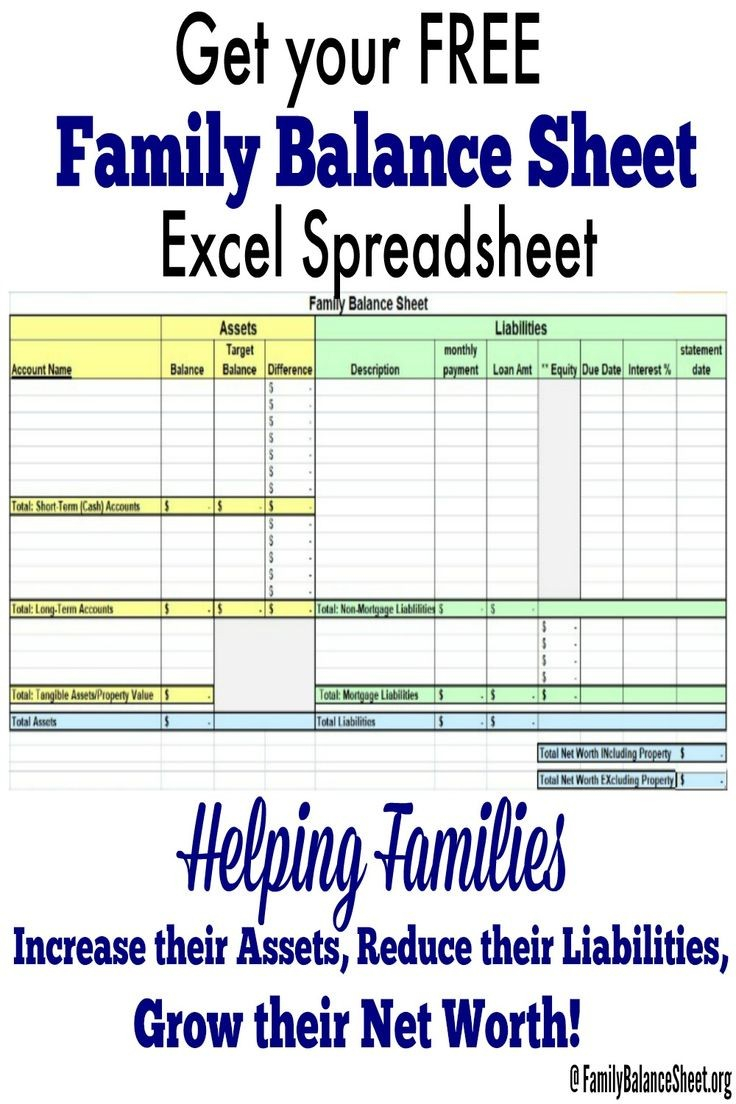

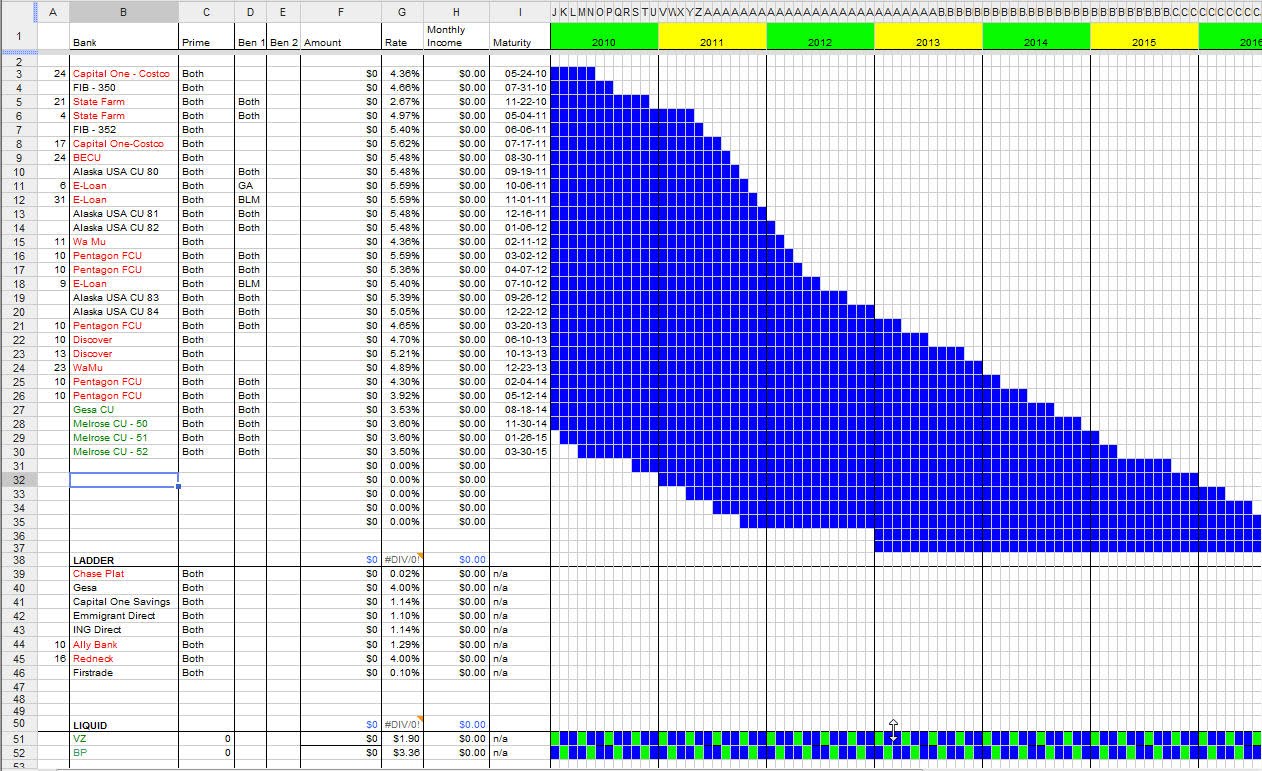

Cd Ladder Spreadsheet Template - Learn more about citi cds and cd rates. The length of the cd determines the amount of guaranteed interest; A cd ladder is a savings strategy where you invest in several certificates of deposit with staggered maturities. Now you know how to set up a cd ladder, use our cd ladder calculator to run a cd ladder simulation and see how much you could earn, based on representative cd ladder rates. Create your own spreadsheet templates with ease and save them on your computer. Web a cd ladder is your best option for a savings portfolio that will deliver both interest income and available cash. Web summary what is a cd ladder? Web a cd ladder is built by depositing a sum of money, equally, across multiple certificates of deposit with a series of maturity dates. When you deposit money to open your cd, you make a promise to the bank that you won’t withdraw your money until the cd’s term ends. I’m trying to create an excel spreadsheet to help me monitor my cd ladder investments.

Now you know how to set up a cd ladder, use our cd ladder calculator to run a cd ladder simulation and see how much you could earn, based on representative cd ladder rates. Web a cd ladder is your best option for a savings portfolio that will deliver both interest income and available cash. The benefits of cd laddering. Web the best cd ladder strategy will mix and match for the optimum balance between terms, minimum deposits, and rates. Intuitive design allows you to build your ladder on one page that includes educational content to make it easier to understand your options. I’m trying to create an excel spreadsheet to help me monitor my cd ladder investments. When you open a cd, you select a term, such as six months, two years or five years. The length of the cd determines the amount of guaranteed interest; However, the problem i’m having is calculating compound interest between two dates, the deposit date and maturity date. Calculator assumes that as each cd in the ladder matures, it is renewed for the term, interest rate, and annual percentage yield (apy) associated with the longest term cd in the laddered portfolio.

However, the problem i’m having is calculating compound interest between two dates, the deposit date and maturity date. Create your own spreadsheet templates with ease and save them on your computer. The length of the cd determines the amount of guaranteed interest; Before we get into the details of how cd ladders work, let’s start with an example. Intuitive design allows you to build your ladder on one page that includes educational content to make it easier to understand your options. Web the best cd ladder strategy will mix and match for the optimum balance between terms, minimum deposits, and rates. Web cd ladder calculation example. Web a cd ladder is your best option for a savings portfolio that will deliver both interest income and available cash. A cd ladder is a savings strategy where you invest in several certificates of deposit with staggered maturities. When you open a cd, you select a term, such as six months, two years or five years.

Cd Ladder Spreadsheet Template Printable Spreadshee cd ladder

A cd ladder is a savings strategy where you invest in several certificates of deposit with staggered maturities. Web cd ladder excel spreadsheet (compound interest) hello, this has been driving me crazy! The benefits of cd laddering. Calculator assumes that as each cd in the ladder matures, it is renewed for the term, interest rate, and annual percentage yield (apy).

Cd Ladder Excel Spreadsheet With Cd Ladder Spreadsheet Csserwis — db

Learn more about citi cds and cd rates. When you open a cd, you select a term, such as six months, two years or five years. When you deposit money to open your cd, you make a promise to the bank that you won’t withdraw your money until the cd’s term ends. Web summary what is a cd ladder? However,.

Cd Ladder Calculator Excel Spreadsheet —

Typically, the longer the maturity of. Web excelgeek's cd ladder spreadsheet; Now you know how to set up a cd ladder, use our cd ladder calculator to run a cd ladder simulation and see how much you could earn, based on representative cd ladder rates. When you deposit money to open your cd, you make a promise to the bank.

Here’s Why You Should Consider a CD Ladder as a Savings Tool American

Create your own spreadsheet templates with ease and save them on your computer. Intuitive design allows you to build your ladder on one page that includes educational content to make it easier to understand your options. The length of the cd determines the amount of guaranteed interest; Web cd ladder calculation example. Web cd ladder calculator citi has cd options.

Cd Ladder Excel Spreadsheet —

Web a cd ladder is your best option for a savings portfolio that will deliver both interest income and available cash. Learn more about citi cds and cd rates. Create your own spreadsheet templates with ease and save them on your computer. I’m trying to create an excel spreadsheet to help me monitor my cd ladder investments. A cd ladder.

Cd Ladder Calculator Excel Spreadsheet Spreadsheet Download cd ladder

The benefits of cd laddering. Web cd ladder calculator citi has cd options to suit your needs. Web the best cd ladder strategy will mix and match for the optimum balance between terms, minimum deposits, and rates. This calculator will help you build a cd ladder that's right for you. Typically, the longer the maturity of.

Cd Ladder Spreadsheet Template Printable Spreadshee cd ladder

Now you know how to set up a cd ladder, use our cd ladder calculator to run a cd ladder simulation and see how much you could earn, based on representative cd ladder rates. Web summary what is a cd ladder? A cd ladder is a savings strategy where you invest in several certificates of deposit with staggered maturities. The.

Cd Ladder Excel Spreadsheet Pertaining To An Awesome And Free

Web a cd ladder is your best option for a savings portfolio that will deliver both interest income and available cash. Web summary what is a cd ladder? Web cd ladder excel spreadsheet (compound interest) hello, this has been driving me crazy! However, the problem i’m having is calculating compound interest between two dates, the deposit date and maturity date..

Cd Ladder Spreadsheet Template pertaining to Cd Ladder Spreadsheet

This calculator will help you build a cd ladder that's right for you. Web excelgeek's cd ladder spreadsheet; The length of the cd determines the amount of guaranteed interest; Now you know how to set up a cd ladder, use our cd ladder calculator to run a cd ladder simulation and see how much you could earn, based on representative.

My Financial Demise? Tracking CD Ladders

When you deposit money to open your cd, you make a promise to the bank that you won’t withdraw your money until the cd’s term ends. However, the problem i’m having is calculating compound interest between two dates, the deposit date and maturity date. Now you know how to set up a cd ladder, use our cd ladder calculator to.

Web The Best Cd Ladder Strategy Will Mix And Match For The Optimum Balance Between Terms, Minimum Deposits, And Rates.

When you deposit money to open your cd, you make a promise to the bank that you won’t withdraw your money until the cd’s term ends. The length of the cd determines the amount of guaranteed interest; A certificate of deposit, or cd, is like a special type of savings account. When you open a cd, you select a term, such as six months, two years or five years.

However, The Problem I’m Having Is Calculating Compound Interest Between Two Dates, The Deposit Date And Maturity Date.

Web cd ladder excel spreadsheet (compound interest) hello, this has been driving me crazy! Typically, the longer the maturity of. Web cd ladder calculator citi has cd options to suit your needs. A cd ladder is a savings strategy where you invest in several certificates of deposit with staggered maturities.

I’m Trying To Create An Excel Spreadsheet To Help Me Monitor My Cd Ladder Investments.

Now you know how to set up a cd ladder, use our cd ladder calculator to run a cd ladder simulation and see how much you could earn, based on representative cd ladder rates. Learn more about citi cds and cd rates. Intuitive design allows you to build your ladder on one page that includes educational content to make it easier to understand your options. Calculator assumes that as each cd in the ladder matures, it is renewed for the term, interest rate, and annual percentage yield (apy) associated with the longest term cd in the laddered portfolio.

The Benefits Of Cd Laddering.

This calculator will help you build a cd ladder that's right for you. Free spreadsheet templates & excel templates. Web a cd ladder is built by depositing a sum of money, equally, across multiple certificates of deposit with a series of maturity dates. Before we get into the details of how cd ladders work, let’s start with an example.