Cp2000 Response Template

Cp2000 Response Template - Review the proposed changes and compare them. Web the most common reasons for a cp2000 notices are taxpayers incorrectly reporting income or failing to report all income received through out the year. However, in a cp2000, the irs automatically proposes changes. Web the cp2000 notice means that the income and payment information the irs has on file for you doesn't match the information you reported in your return. What do i do if i receive a cp 2000? Web how to respond if the reporting party made an error. About 3 minutes) (time required: ³&{ ˜´w ;ì‡, '½ònz°ç‡ëá)ë §„ñ ¶€äîçû{£‡e€”qµk ›!†3î“œ )÷ ej @z s „|. Determine if you agree or disagree. The theme dialog box appears, showing the theme in your current document.

Web the most common reasons for a cp2000 notices are taxpayers incorrectly reporting income or failing to report all income received through out the year. Review the information on the cp2000 carefully for accuracy. Normally, you can get up to 30 additional days to. Web a cp2000 notice is an irs letter telling you that the irs has adjusted your income tax return and you owe money. ³&{ ˜´w ;ì‡, '½ònz°ç‡ëá)ë §„ñ ¶€äîçû{£‡e€”qµk ›!†3î“œ )÷ ej @z s „|. Web •complete, sign and date the response form on page 5, and mail it to us along with your payment of $969 so we receive it by june 12, 2013 • if you can’t pay the amount due, pay. Web letter cp 2000 is sent to notify you that one or more items on your return don’t match what was reported to the irs by third parties (e.g., employers or financial. However, in a cp2000, the irs automatically proposes changes. The irs will compute the additional tax due and send you a cp2000 (or letter 2030). Web use a cp2000 response letter sample template to make your document workflow more streamlined.

Web the phone number will be on your cp2000 notice. What triggers irs to send a cp 2000 letter? If you don’t agree with some or all of the proposed. Show details how it works browse for the irs cp2000 response letter. Web below we have sample cp2000 response letters that you can use to edit and send out for your response. Determine if you agree or disagree. What do i do if i receive a cp 2000? Web letter cp 2000 is sent to notify you that one or more items on your return don’t match what was reported to the irs by third parties (e.g., employers or financial. Web the cp2000 is a legal procedure that mimics an irs audit by the procedure of making changes to your taxes. Web •complete, sign and date the response form on page 5, and mail it to us along with your payment of $969 so we receive it by june 12, 2013 • if you can’t pay the amount due, pay.

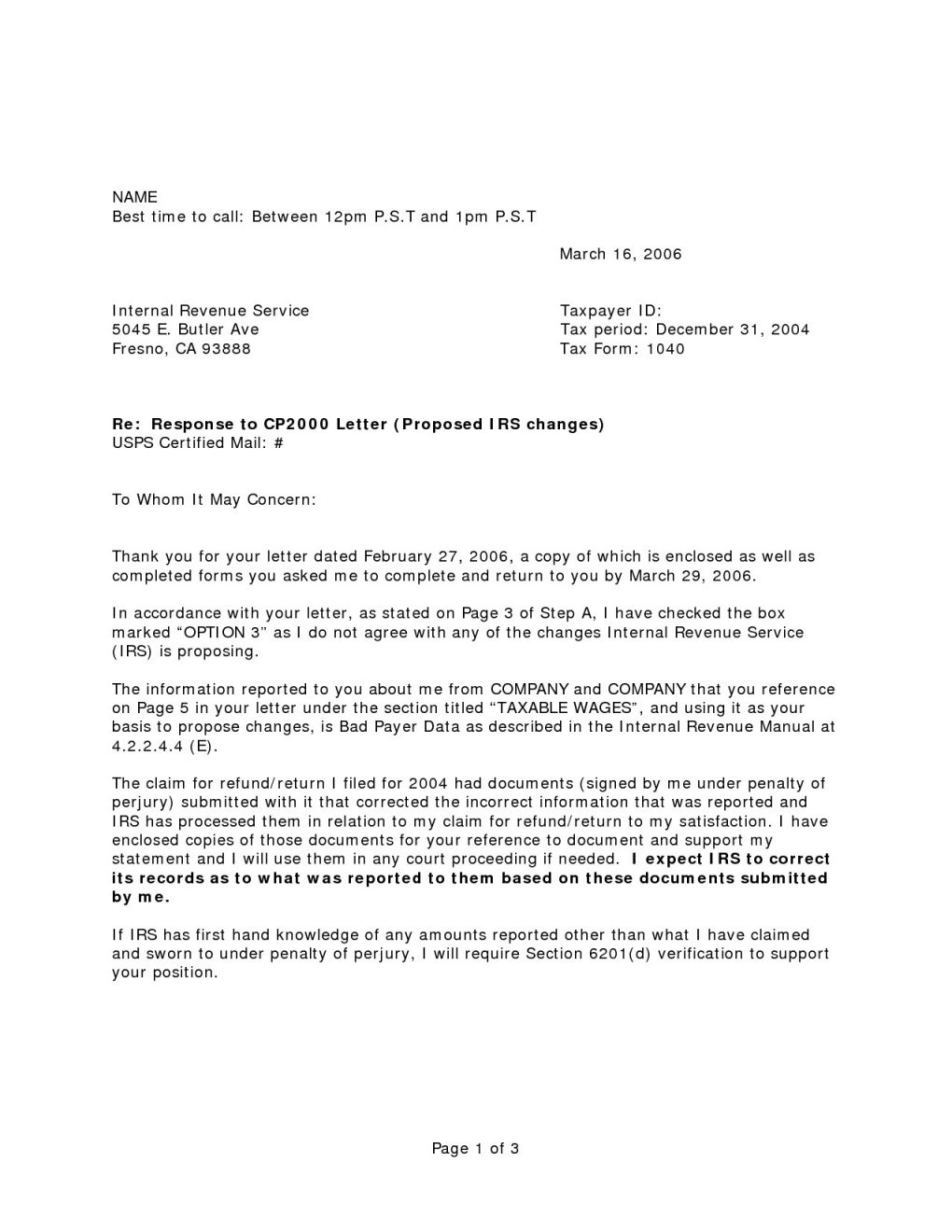

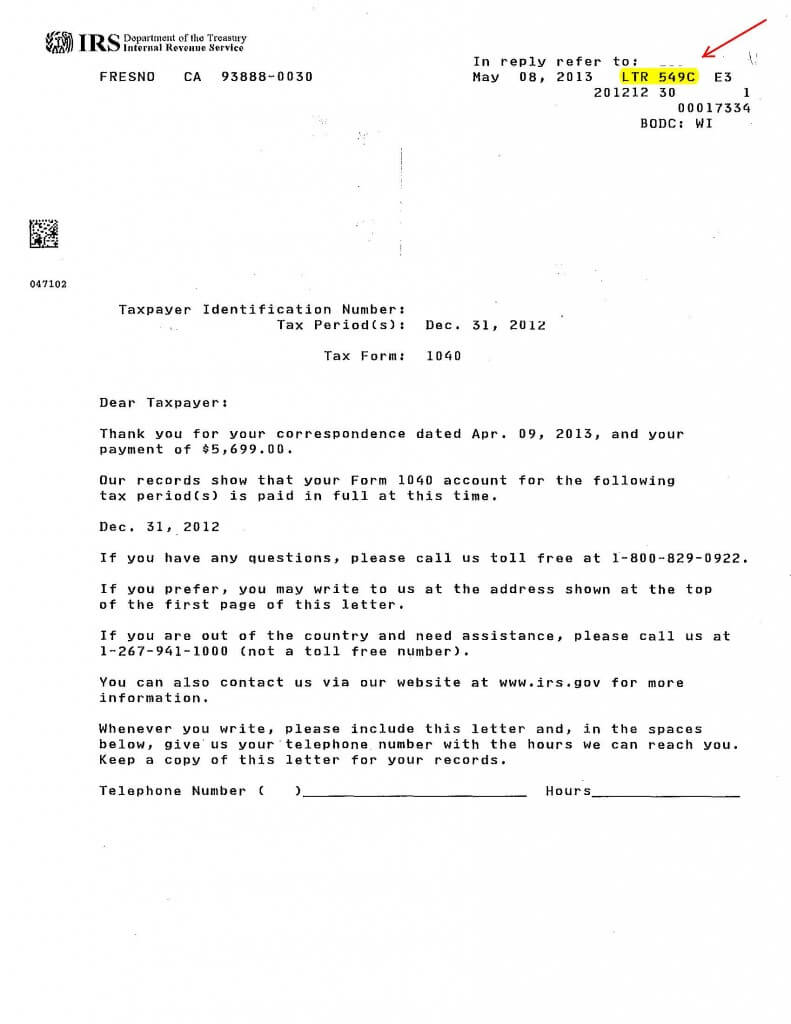

IRS Audit Letter CP2000 Sample 4

However, in a cp2000, the irs automatically proposes changes. Review the information on the cp2000 carefully for accuracy. Click the style gallery button (located at the bottom of the dialog box). Web the cp2000 notice means that the income and payment information the irs has on file for you doesn't match the information you reported in your return. Cp2000 forms.

Subcontractor Letter Of Intent Template Examples Letter Template

Review the information on the cp2000 carefully for accuracy. Web the response form by the due date. What do i do if i receive a cp 2000? Cp2000 forms are also called under. Click the style gallery button (located at the bottom of the dialog box).

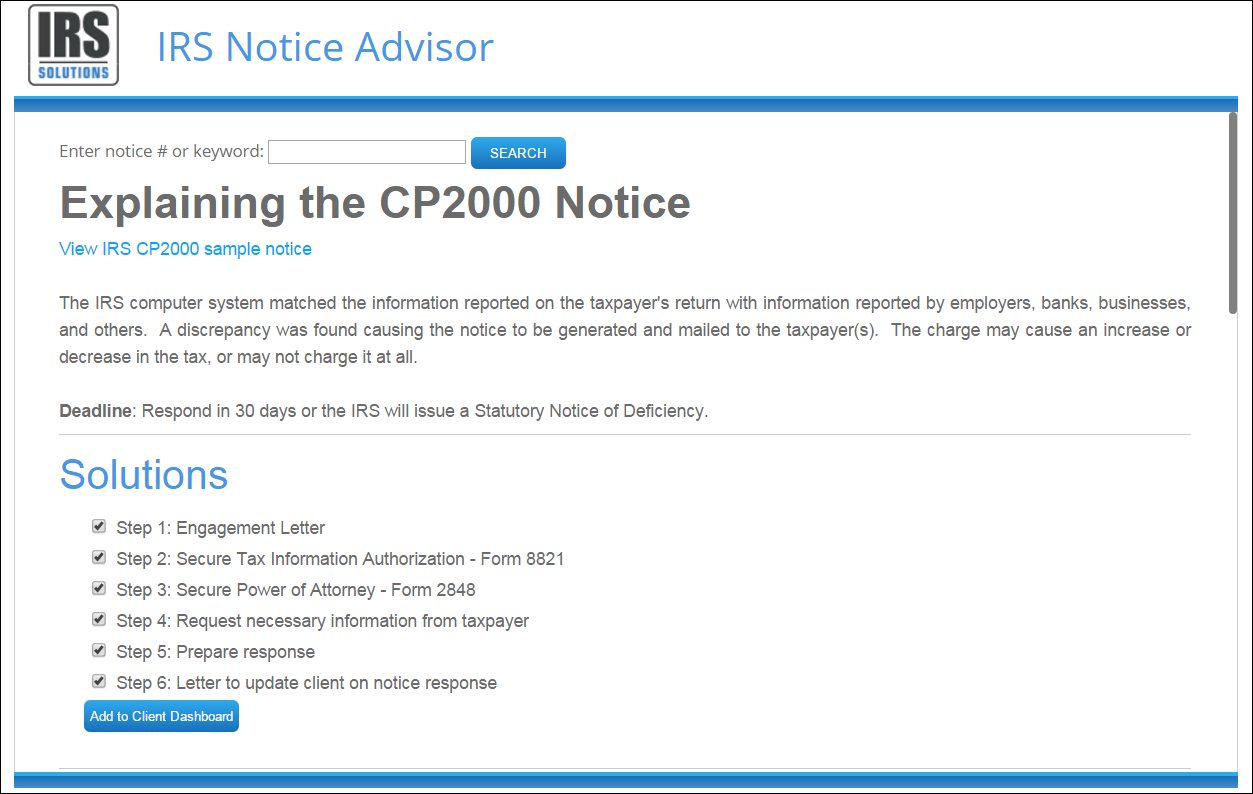

IRS Notice Advisor IRS Solutions Software

Web how to respond to irs letter cp 2000 what is a cp 2000? What do i do if i receive a cp 2000? Cp2000 forms are also called under. Determine if you agree or disagree. Show details how it works browse for the irs cp2000 response letter.

Cp2000 Response Letter Template Samples Letter Template Collection

It will usually contain the heading “notice of. Sign the letter and send it back to the irs, which will send you an updated tax bill. What triggers irs to send a cp 2000 letter? Click the style gallery button (located at the bottom of the dialog box). Have your irs notice and tax return information handy when you call.

Letter to the IRS IRS Response Letter Form (with Sample) Business

Web how to respond to irs letter cp 2000 what is a cp 2000? Web the response form by the due date. Web letter cp 2000 is sent to notify you that one or more items on your return don’t match what was reported to the irs by third parties (e.g., employers or financial. Web the cp2000 is a legal.

ads/responsive.txt Irs Cp2000 Response form Pdf Awesome Outstanding

About 15 minutes) remove the nine (9) screws marked. Web •complete, sign and date the response form on page 5, and mail it to us along with your payment of $969 so we receive it by june 12, 2013 • if you can’t pay the amount due, pay. Review the information on the cp2000 carefully for accuracy. Web how to.

Cp2000 Response Letter Template Samples Letter Template Collection

Web the response form by the due date. Web •complete, sign and date the response form on page 5, and mail it to us along with your payment of $969 so we receive it by june 12, 2013 • if you can’t pay the amount due, pay. Web a response form, payment voucher, and an envelope. Determine if you agree.

Cp2000 Response Letter Template Samples Letter Template Collection

The irs will compute the additional tax due and send you a cp2000 (or letter 2030). Web below we have sample cp2000 response letters that you can use to edit and send out for your response. About 3 minutes) (time required: However, in a cp2000, the irs automatically proposes changes. Web how to respond if the reporting party made an.

Irs Response Letter Template Samples Letter Template Collection

Web the irs sends cp2000, proposed changes to your tax return, if there is a mismatch between the information reported on your tax return and the payment or. The irs will compute the additional tax due and send you a cp2000 (or letter 2030). Click the style gallery button (located at the bottom of the dialog box). Click here for.

IRS Audit Letter CP2000 Sample 4

Web how to respond if the reporting party made an error. What do i do if i receive a cp 2000? About 3 minutes) (time required: Web a cp2000 notice is an irs letter telling you that the irs has adjusted your income tax return and you owe money. Web cp2000 disassembly procedure top cover ac2/6 circuit board (time required:

It Will Usually Contain The Heading “Notice Of.

Web letter cp 2000 is sent to notify you that one or more items on your return don’t match what was reported to the irs by third parties (e.g., employers or financial. Review the proposed changes and compare them. Web the cp2000 notice means that the income and payment information the irs has on file for you doesn't match the information you reported in your return. What do i do if i receive a cp 2000?

Web The Response Form By The Due Date.

The irs will compute the additional tax due and send you a cp2000 (or letter 2030). Sign the letter and send it back to the irs, which will send you an updated tax bill. Web the most common reasons for a cp2000 notices are taxpayers incorrectly reporting income or failing to report all income received through out the year. Click here for stock sale cp2000 response letter.

Web How To Respond If The Reporting Party Made An Error.

Web use a cp2000 response letter sample template to make your document workflow more streamlined. Web cp2000 disassembly procedure top cover ac2/6 circuit board (time required: The theme dialog box appears, showing the theme in your current document. Web a response form, payment voucher, and an envelope.

Web The Phone Number Will Be On Your Cp2000 Notice.

Web •complete, sign and date the response form on page 5, and mail it to us along with your payment of $969 so we receive it by june 12, 2013 • if you can’t pay the amount due, pay. ³&{ ˜´w ;ì‡, '½ònz°ç‡ëá)ë §„ñ ¶€äîçû{£‡e€”qµk ›!†3î“œ )÷ ej @z s „|. Web a cp2000 notice is an irs letter telling you that the irs has adjusted your income tax return and you owe money. Cp2000 forms are also called under.