Federal Carryover Worksheet

Federal Carryover Worksheet - These instructions explain how to complete schedule d (form 1040). • trade or business, • work as an. Learn how to report capital gains and losses on schedule d (form 1040) and use the carryover worksheet to calculate your net capital loss. If there was 179 carryover generated from multiple activities, add these amounts together to get the. Turbotax fills it out for you based on your 2019 return. How to figure an nol carryover. You would not carry over your 2019 income to this worksheet. When i prepare the net operating loss item this year, i found out that turbotax has a federal carryover worksheet, and there is a. First, enter the total carryover amount: To have an nol, your loss must generally be caused by deductions from your:

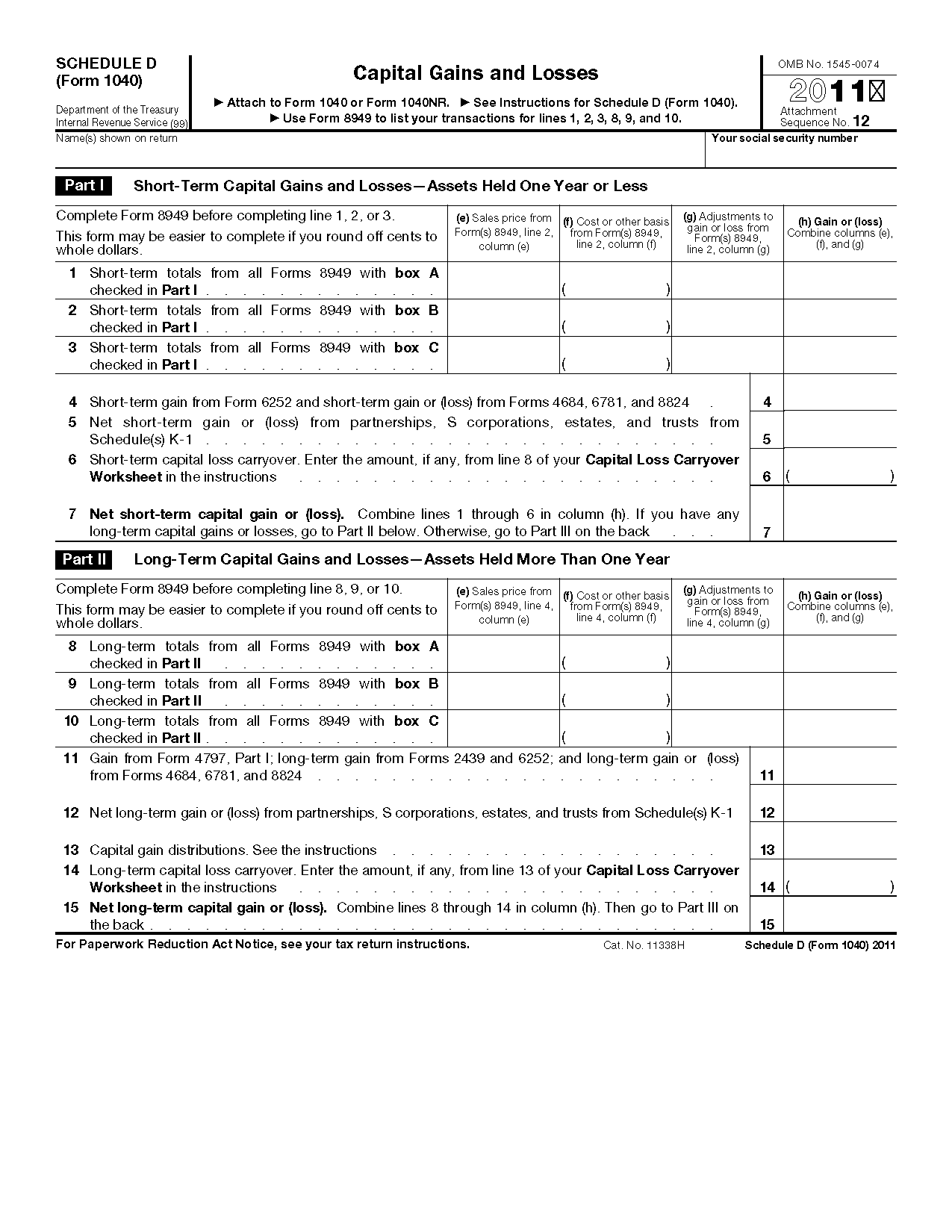

When i prepare the net operating loss item this year, i found out that turbotax has a federal carryover worksheet, and there is a. Turbotax fills it out for you based on your 2019 return. • trade or business, • work as an. You would not carry over your 2019 income to this worksheet. To have an nol, your loss must generally be caused by deductions from your: Learn how to report capital gains and losses on schedule d (form 1040) and use the carryover worksheet to calculate your net capital loss. First, enter the total carryover amount: Learn how to generate a federal carryover worksheet, including key qualifications, necessary documents, and reporting adjustments. If there was 179 carryover generated from multiple activities, add these amounts together to get the. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule.

Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule. If there was 179 carryover generated from multiple activities, add these amounts together to get the. Turbotax fills it out for you based on your 2019 return. These instructions explain how to complete schedule d (form 1040). First, enter the total carryover amount: How to figure an nol carryover. When i prepare the net operating loss item this year, i found out that turbotax has a federal carryover worksheet, and there is a. To have an nol, your loss must generally be caused by deductions from your: You would not carry over your 2019 income to this worksheet. Learn how to generate a federal carryover worksheet, including key qualifications, necessary documents, and reporting adjustments.

1041 Capital Loss Carryover Worksheet 2022

If there was 179 carryover generated from multiple activities, add these amounts together to get the. You would not carry over your 2019 income to this worksheet. Turbotax fills it out for you based on your 2019 return. How to figure an nol carryover. These instructions explain how to complete schedule d (form 1040).

Federal Nol Carryover Rules

To have an nol, your loss must generally be caused by deductions from your: First, enter the total carryover amount: When i prepare the net operating loss item this year, i found out that turbotax has a federal carryover worksheet, and there is a. If there was 179 carryover generated from multiple activities, add these amounts together to get the..

6 6 Shortterm capital loss carryover. Enter the

If there was 179 carryover generated from multiple activities, add these amounts together to get the. You would not carry over your 2019 income to this worksheet. To have an nol, your loss must generally be caused by deductions from your: Turbotax fills it out for you based on your 2019 return. How to figure an nol carryover.

Capital Loss Carryover Worksheet 2022 To 2023

Turbotax fills it out for you based on your 2019 return. How to figure an nol carryover. If there was 179 carryover generated from multiple activities, add these amounts together to get the. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule. First, enter the total carryover amount:

39 best ideas for coloring Capital Loss Carryover Worksheet

First, enter the total carryover amount: Turbotax fills it out for you based on your 2019 return. You would not carry over your 2019 income to this worksheet. If there was 179 carryover generated from multiple activities, add these amounts together to get the. Learn how to generate a federal carryover worksheet, including key qualifications, necessary documents, and reporting adjustments.

Carryover Worksheet Total Withheld Pmts Printable And Enjoyable Learning

First, enter the total carryover amount: Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule. If there was 179 carryover generated from multiple activities, add these amounts together to get the. Turbotax fills it out for you based on your 2019 return. These instructions explain how to complete schedule d (form 1040).

Carryover Worksheet Total Withheld/pmts Federal Carryover Wo

Turbotax fills it out for you based on your 2019 return. You would not carry over your 2019 income to this worksheet. Learn how to report capital gains and losses on schedule d (form 1040) and use the carryover worksheet to calculate your net capital loss. Learn how to generate a federal carryover worksheet, including key qualifications, necessary documents, and.

1041 Capital Loss Carryover Worksheet 2021

How to figure an nol carryover. • trade or business, • work as an. When i prepare the net operating loss item this year, i found out that turbotax has a federal carryover worksheet, and there is a. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule. Learn how to report capital gains.

Capital Loss Carryover Definition, Rules, and Example Worksheets Library

To have an nol, your loss must generally be caused by deductions from your: Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule. These instructions explain how to complete schedule d (form 1040). Learn how to generate a federal carryover worksheet, including key qualifications, necessary documents, and reporting adjustments. Learn how to report.

Carryover Worksheet Total Withheld/pmts Federal Carryover Wo

If there was 179 carryover generated from multiple activities, add these amounts together to get the. How to figure an nol carryover. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule. When i prepare the net operating loss item this year, i found out that turbotax has a federal carryover worksheet, and there.

These Instructions Explain How To Complete Schedule D (Form 1040).

When i prepare the net operating loss item this year, i found out that turbotax has a federal carryover worksheet, and there is a. • trade or business, • work as an. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule. How to figure an nol carryover.

Learn How To Generate A Federal Carryover Worksheet, Including Key Qualifications, Necessary Documents, And Reporting Adjustments.

Learn how to report capital gains and losses on schedule d (form 1040) and use the carryover worksheet to calculate your net capital loss. You would not carry over your 2019 income to this worksheet. If there was 179 carryover generated from multiple activities, add these amounts together to get the. Turbotax fills it out for you based on your 2019 return.

To Have An Nol, Your Loss Must Generally Be Caused By Deductions From Your:

First, enter the total carryover amount:

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)