Irs Appeal Letter Template

Irs Appeal Letter Template - The letter that you received from the irs proposing the changes may contain important information about. Protest the assessment of taxes and/or penalties and proactively request an appeals conference to protect taxpayer rights and resolve various tax. See www.irs.gov/appeals for more information. An effectively drafted protest sets the stage for obtaining a fair. To take a case to appeals, the taxpayer must protest in writing the irs’ proposed action. Below, you’ll find an overview of these two case determinations and how the irs assesses them. If the total amount you’re disputing for any one tax. After you determine you meet the criteria for an appeal, (considering an appeal) you may request an appeal by filing a written protest.

Protest the assessment of taxes and/or penalties and proactively request an appeals conference to protect taxpayer rights and resolve various tax. See www.irs.gov/appeals for more information. Below, you’ll find an overview of these two case determinations and how the irs assesses them. To take a case to appeals, the taxpayer must protest in writing the irs’ proposed action. If the total amount you’re disputing for any one tax. The letter that you received from the irs proposing the changes may contain important information about. An effectively drafted protest sets the stage for obtaining a fair. After you determine you meet the criteria for an appeal, (considering an appeal) you may request an appeal by filing a written protest.

See www.irs.gov/appeals for more information. Below, you’ll find an overview of these two case determinations and how the irs assesses them. If the total amount you’re disputing for any one tax. An effectively drafted protest sets the stage for obtaining a fair. To take a case to appeals, the taxpayer must protest in writing the irs’ proposed action. The letter that you received from the irs proposing the changes may contain important information about. After you determine you meet the criteria for an appeal, (considering an appeal) you may request an appeal by filing a written protest. Protest the assessment of taxes and/or penalties and proactively request an appeals conference to protect taxpayer rights and resolve various tax.

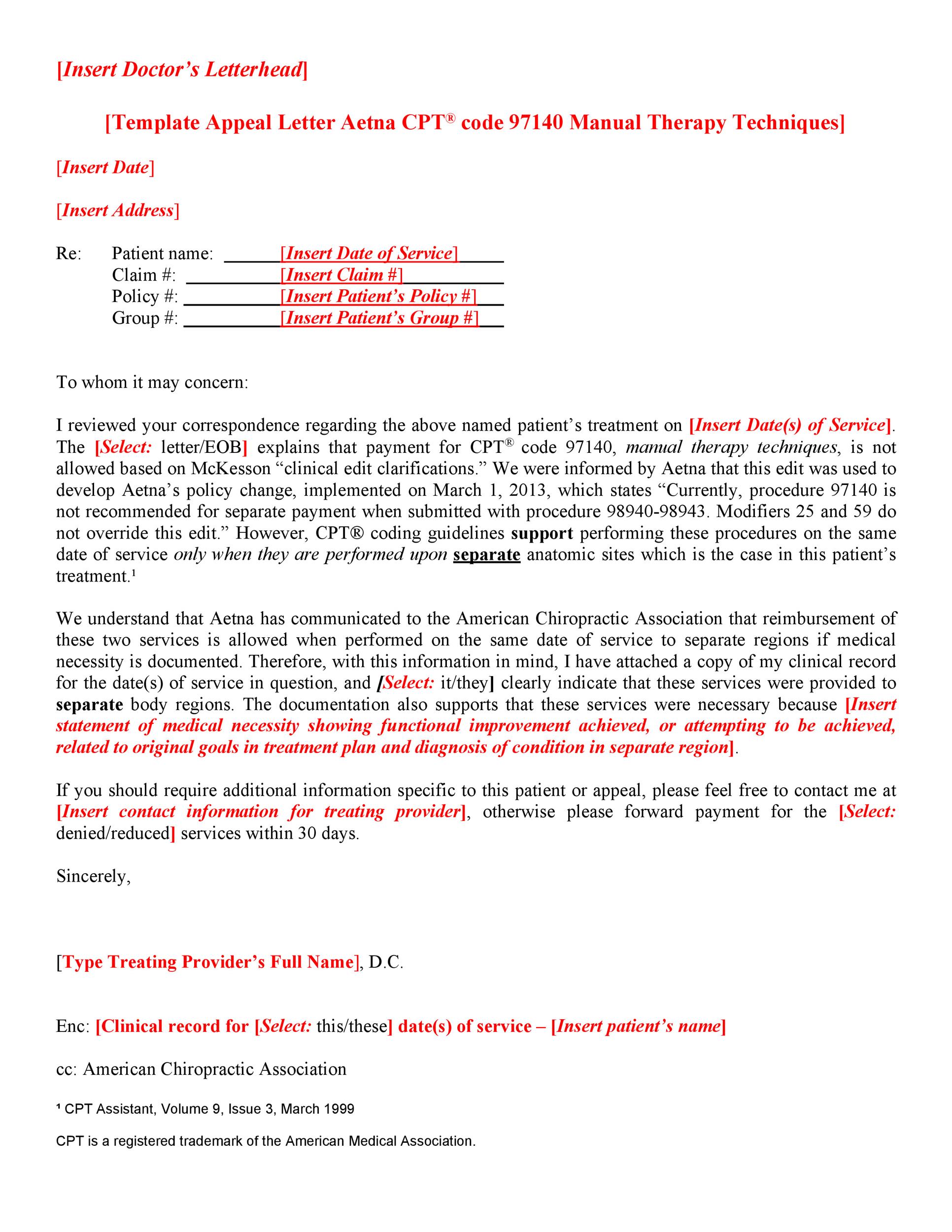

13+ Sample Irs Appeal Letter SineadArchie

Below, you’ll find an overview of these two case determinations and how the irs assesses them. If the total amount you’re disputing for any one tax. An effectively drafted protest sets the stage for obtaining a fair. See www.irs.gov/appeals for more information. The letter that you received from the irs proposing the changes may contain important information about.

13+ Sample Irs Appeal Letter SineadArchie

See www.irs.gov/appeals for more information. To take a case to appeals, the taxpayer must protest in writing the irs’ proposed action. The letter that you received from the irs proposing the changes may contain important information about. Below, you’ll find an overview of these two case determinations and how the irs assesses them. An effectively drafted protest sets the stage.

Irs Appeal Letter Template

Below, you’ll find an overview of these two case determinations and how the irs assesses them. If the total amount you’re disputing for any one tax. To take a case to appeals, the taxpayer must protest in writing the irs’ proposed action. The letter that you received from the irs proposing the changes may contain important information about. An effectively.

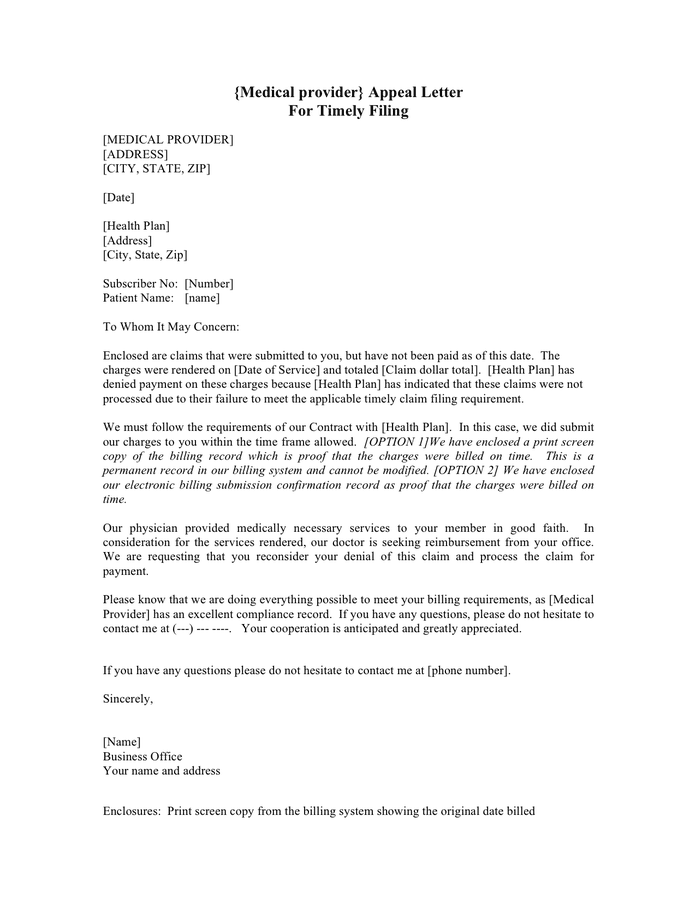

Irs Appeal Letter Sample Late Filing Fee

The letter that you received from the irs proposing the changes may contain important information about. After you determine you meet the criteria for an appeal, (considering an appeal) you may request an appeal by filing a written protest. To take a case to appeals, the taxpayer must protest in writing the irs’ proposed action. Below, you’ll find an overview.

Appeal Letter Sample download free documents for PDF, Word and Excel

See www.irs.gov/appeals for more information. To take a case to appeals, the taxpayer must protest in writing the irs’ proposed action. Below, you’ll find an overview of these two case determinations and how the irs assesses them. Protest the assessment of taxes and/or penalties and proactively request an appeals conference to protect taxpayer rights and resolve various tax. After you.

Irs Appeal Letter Sample SampleTemplatess SampleTemplatess

To take a case to appeals, the taxpayer must protest in writing the irs’ proposed action. Below, you’ll find an overview of these two case determinations and how the irs assesses them. Protest the assessment of taxes and/or penalties and proactively request an appeals conference to protect taxpayer rights and resolve various tax. The letter that you received from the.

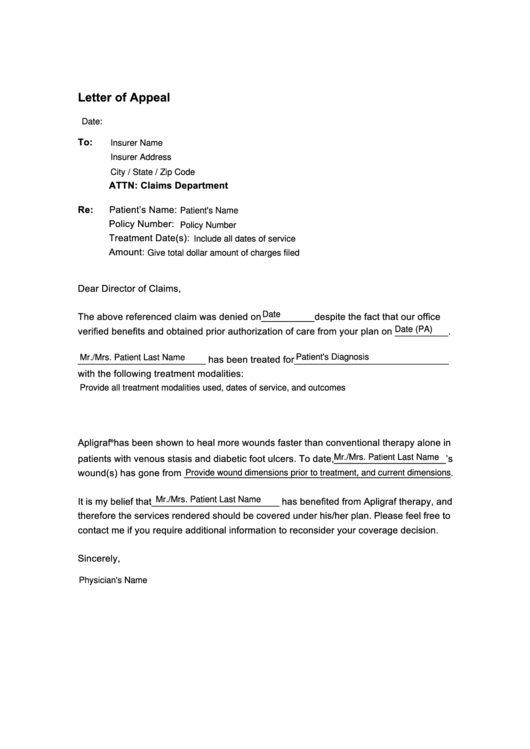

Fillable Letter Of Appeal Template printable pdf download

Protest the assessment of taxes and/or penalties and proactively request an appeals conference to protect taxpayer rights and resolve various tax. Below, you’ll find an overview of these two case determinations and how the irs assesses them. See www.irs.gov/appeals for more information. To take a case to appeals, the taxpayer must protest in writing the irs’ proposed action. An effectively.

FREE 11+ Sample Example of Appeal Letter Templates in PDF MS Word

See www.irs.gov/appeals for more information. If the total amount you’re disputing for any one tax. Below, you’ll find an overview of these two case determinations and how the irs assesses them. The letter that you received from the irs proposing the changes may contain important information about. Protest the assessment of taxes and/or penalties and proactively request an appeals conference.

22 Free Appeal Letter Templates (Financial Aid, Employment, College, etc)

To take a case to appeals, the taxpayer must protest in writing the irs’ proposed action. An effectively drafted protest sets the stage for obtaining a fair. If the total amount you’re disputing for any one tax. Below, you’ll find an overview of these two case determinations and how the irs assesses them. Protest the assessment of taxes and/or penalties.

How Do I Write An Appeal Letter To The Irs Alice Writing

See www.irs.gov/appeals for more information. To take a case to appeals, the taxpayer must protest in writing the irs’ proposed action. After you determine you meet the criteria for an appeal, (considering an appeal) you may request an appeal by filing a written protest. The letter that you received from the irs proposing the changes may contain important information about..

An Effectively Drafted Protest Sets The Stage For Obtaining A Fair.

Below, you’ll find an overview of these two case determinations and how the irs assesses them. After you determine you meet the criteria for an appeal, (considering an appeal) you may request an appeal by filing a written protest. If the total amount you’re disputing for any one tax. Protest the assessment of taxes and/or penalties and proactively request an appeals conference to protect taxpayer rights and resolve various tax.

See Www.irs.gov/Appeals For More Information.

To take a case to appeals, the taxpayer must protest in writing the irs’ proposed action. The letter that you received from the irs proposing the changes may contain important information about.

/4155244v1-5baf7fabc9e77c0051476fa2.png)