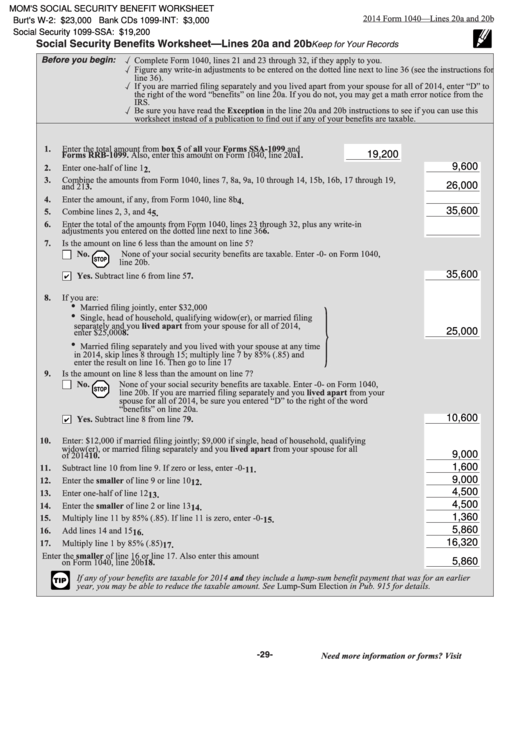

Social Security Taxable Benefits Worksheet

Social Security Taxable Benefits Worksheet - Find the current revision, recent. Use this worksheet to determine if your social security and/or ssi benefits are taxable. Find out how to calculate the. The taxable portion can range from 50 to 85 percent of your benefits. The worksheet provided can be used to determine the exact amount. Learn how to assist taxpayers who have social security and railroad retirement benefits that may be taxable.

The worksheet provided can be used to determine the exact amount. Use this worksheet to determine if your social security and/or ssi benefits are taxable. Find out how to calculate the. Learn how to assist taxpayers who have social security and railroad retirement benefits that may be taxable. The taxable portion can range from 50 to 85 percent of your benefits. Find the current revision, recent.

Find out how to calculate the. Use this worksheet to determine if your social security and/or ssi benefits are taxable. The taxable portion can range from 50 to 85 percent of your benefits. The worksheet provided can be used to determine the exact amount. Find the current revision, recent. Learn how to assist taxpayers who have social security and railroad retirement benefits that may be taxable.

Social Security Benefits Worksheet 2021 Pdf

The worksheet provided can be used to determine the exact amount. Find out how to calculate the. Find the current revision, recent. Use this worksheet to determine if your social security and/or ssi benefits are taxable. The taxable portion can range from 50 to 85 percent of your benefits.

Form 1040 Social Security Worksheet 2023

Find the current revision, recent. Learn how to assist taxpayers who have social security and railroad retirement benefits that may be taxable. Find out how to calculate the. Use this worksheet to determine if your social security and/or ssi benefits are taxable. The worksheet provided can be used to determine the exact amount.

Social Security Taxable Worksheet 2022

The taxable portion can range from 50 to 85 percent of your benefits. Find the current revision, recent. Find out how to calculate the. Use this worksheet to determine if your social security and/or ssi benefits are taxable. Learn how to assist taxpayers who have social security and railroad retirement benefits that may be taxable.

Taxable Social Security Worksheet 2022 Irs Publication 915 2

Learn how to assist taxpayers who have social security and railroad retirement benefits that may be taxable. Find out how to calculate the. The worksheet provided can be used to determine the exact amount. Use this worksheet to determine if your social security and/or ssi benefits are taxable. Find the current revision, recent.

Taxable Social Security Worksheet 2021 Fill Online, Printable 6AB

Use this worksheet to determine if your social security and/or ssi benefits are taxable. The taxable portion can range from 50 to 85 percent of your benefits. Find out how to calculate the. The worksheet provided can be used to determine the exact amount. Find the current revision, recent.

Social Security Benefits Worksheet 2023 Line 6a And 6b Socia

Use this worksheet to determine if your social security and/or ssi benefits are taxable. Find the current revision, recent. The worksheet provided can be used to determine the exact amount. The taxable portion can range from 50 to 85 percent of your benefits. Learn how to assist taxpayers who have social security and railroad retirement benefits that may be taxable.

2020 Social Security Benefits Worksheets

The worksheet provided can be used to determine the exact amount. Learn how to assist taxpayers who have social security and railroad retirement benefits that may be taxable. Use this worksheet to determine if your social security and/or ssi benefits are taxable. Find out how to calculate the. The taxable portion can range from 50 to 85 percent of your.

Taxation of Social Security Benefits KLRD Worksheets Library

The taxable portion can range from 50 to 85 percent of your benefits. Find the current revision, recent. Use this worksheet to determine if your social security and/or ssi benefits are taxable. Learn how to assist taxpayers who have social security and railroad retirement benefits that may be taxable. Find out how to calculate the.

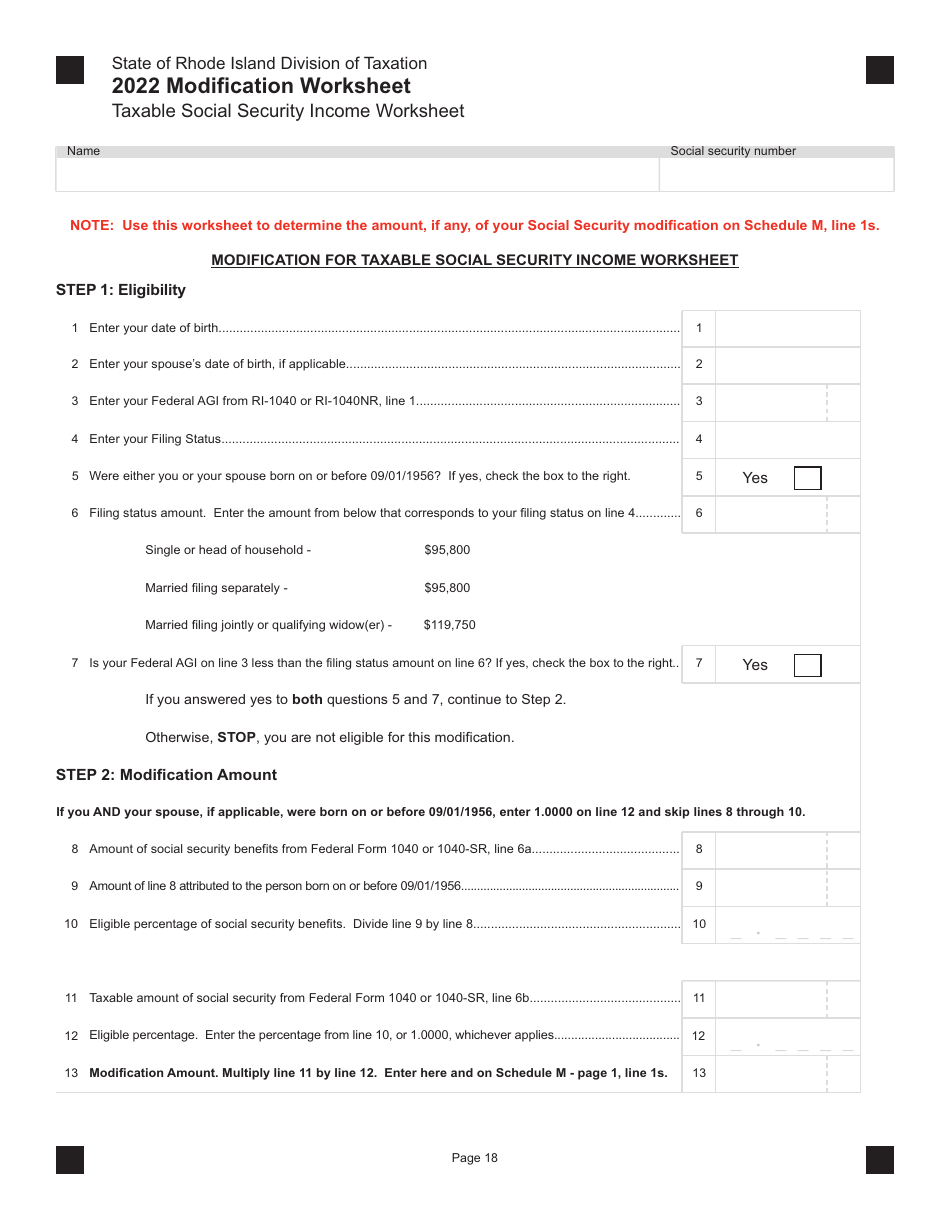

2022 Rhode Island Taxable Social Security Worksheet Download

The taxable portion can range from 50 to 85 percent of your benefits. Learn how to assist taxpayers who have social security and railroad retirement benefits that may be taxable. Find the current revision, recent. Find out how to calculate the. The worksheet provided can be used to determine the exact amount.

Social Security Taxable Worksheets

Learn how to assist taxpayers who have social security and railroad retirement benefits that may be taxable. The taxable portion can range from 50 to 85 percent of your benefits. Find out how to calculate the. The worksheet provided can be used to determine the exact amount. Find the current revision, recent.

Use This Worksheet To Determine If Your Social Security And/Or Ssi Benefits Are Taxable.

Find the current revision, recent. Learn how to assist taxpayers who have social security and railroad retirement benefits that may be taxable. The taxable portion can range from 50 to 85 percent of your benefits. The worksheet provided can be used to determine the exact amount.